How To Determine a Stocks Book Value

- by:

- Nick H

Key Points

Book value represents the net asset value of a company, calculated as total assets minus total liabilities and preferred equity

The price-to-book (P/B) ratio allows investors to compare a company’s market price to its book value

Book value is best used alongside other valuation methods, as it may not fully reflect intangible assets or current market conditions

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

When diving into the world of investing, one term that surfaces frequently is “book value.” For anyone analyzing stocks, understanding book value is crucial. It serves as a foundation for many valuation techniques and offers insight into a company’s underlying worth. This article will break down what book value means, how it is calculated, and how investors can use it to make better investment decisions.

Understanding Book Value

Book value refers to the net asset value of a company, calculated as total assets minus total liabilities, as recorded on the balance sheet. It essentially represents the value of a company’s assets that shareholders would theoretically receive if the company were to liquidate its assets and pay off all debts. Book value is distinct from market value, which is determined by the current price at which shares trade in the stock market.

Book value is often expressed on a per-share basis, known as Book Value Per Share (BVPS), to allow investors to make meaningful comparisons between companies of different sizes and to judge whether a stock is undervalued or overvalued relative to its accounting value.

The Importance of Book Value

Why should investors care about book value? Book value provides a baseline measure of a company’s tangible worth. If a stock’s market price is trading below its book value, it might signal an undervalued opportunity. However, there are many nuances, and book value is only one tool among many that investors should use.

Book value is particularly important in sectors with significant physical assets, such as manufacturing, energy, or utilities. For technology or service-based firms, book value may be less relevant due to the prevalence of intangible assets.

Components Needed to Calculate Book Value

To determine a company’s book value, you will need access to its balance sheet, which can be found in quarterly and annual reports or financial databases. The essential components include:

Total Assets: These are everything the company owns, from cash to buildings, machinery, inventory, and receivables.

Total Liabilities: These are all of the company’s debts and obligations, including loans, accounts payable, and accrued expenses.

Preferred Equity (if applicable): If a company has issued preferred shares, this amount must be subtracted, as book value is intended to reflect only the value available to common shareholders.

Step-by-Step Process to Determine Book Value

1. Locate the Company’s Financial Statements

Begin by accessing the company’s balance sheet. This can typically be found in the investor relations section of the company’s website, in quarterly or annual filings such as the 10-Q or 10-K in the United States.

2. Identify Total Assets

Total assets are listed on the balance sheet. This figure includes both current assets (cash, inventory, receivables) and non-current assets (property, equipment, goodwill, patents).

3. Identify Total Liabilities

Just below the assets, you will find total liabilities. This includes all financial obligations, such as loans, bonds payable, accounts payable, accrued expenses, and other debts.

4. Identify Preferred Equity (if any)

If the company has preferred shares, you will find a line item for preferred stock in the equity section. This amount needs to be excluded from the calculation for common shareholders.

5. Calculate Common Shareholder Equity

Subtract total liabilities and preferred equity from total assets to arrive at common shareholder equity:

Common Shareholder Equity = Total Assets minus Total Liabilities minus Preferred Equity

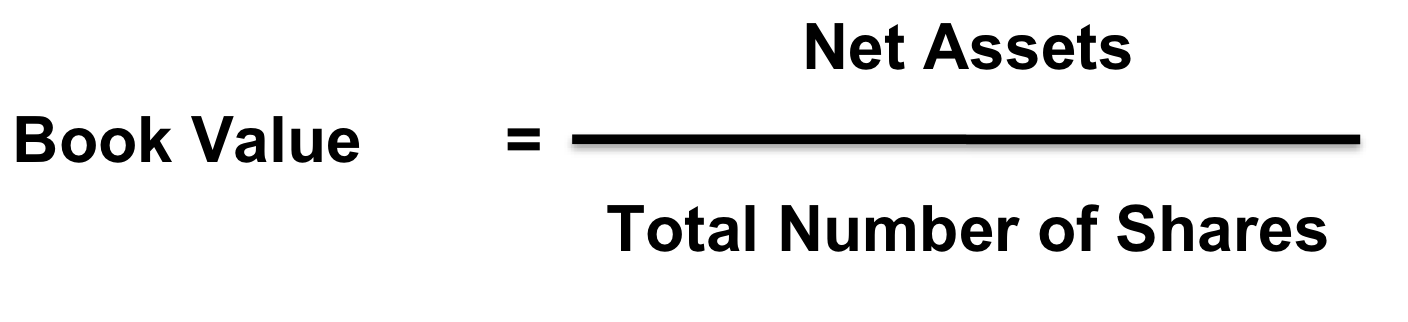

6. Calculate Book Value Per Share

To get the per-share figure, divide the common shareholder equity by the number of outstanding common shares:

Book Value Per Share = Common Shareholder Equity divided by Number of Outstanding Common Shares

This final figure gives investors a sense of how much net asset value is theoretically available for each share of common stock.

Most Like Articles

Example Calculation

Let’s walk through a simple example:

Suppose a company reports the following on its balance sheet:

Total Assets: $500 million

Total Liabilities: $350 million

Preferred Equity: $30 million

Outstanding Common Shares: 10 million

First, calculate common shareholder equity:

$500 million (assets) minus $350 million (liabilities) minus $30 million (preferred equity) = $120 million

Next, divide by the number of common shares:

$120 million divided by 10 million shares = $12 book value per share

This means that each share represents $12 of net asset value on the company’s books.

Book Value vs. Market Value

Book value is not the same as market value. Market value is determined by the share price times the number of outstanding shares and can fluctuate based on investor sentiment, future growth prospects, and other factors. Book value, in contrast, is a historical measure based on accounting values, which can be affected by depreciation policies, asset write-downs, and accounting conventions.

A stock trading below its book value might look like a bargain, but it is important to ask why the market is valuing it so low. Sometimes, a low price-to-book ratio may indicate that the company is facing business challenges, outdated assets, or poor growth prospects.

The Price-to-Book Ratio

Investors often use the price-to-book (P/B) ratio to compare a company’s market value to its book value. The formula is:

Price-to-Book Ratio = Market Price Per Share divided by Book Value Per Share

A P/B ratio below 1 could suggest the stock is undervalued, while a P/B above 1 might indicate the stock is valued higher than its net assets. Context matters here; a low P/B can also signal deeper issues with the business.

Limitations of Book Value

While book value is a useful metric, it has its limitations:

Intangible Assets: Many modern companies derive their value from intangibles such as patents, brand reputation, software, or intellectual property, which may not be fully reflected on the balance sheet.

Asset Valuation: The value of assets can change over time, and accounting rules may not always reflect current market values.

Industry Differences: Asset-heavy industries find book value more relevant, while for service and tech firms, it may not tell the whole story.

Ways Investors Use Book Value

Book value is most powerful when used alongside other valuation methods. Investors may use it to:

Screen for potentially undervalued stocks

Assess financial stability, especially for banks or insurers

Compare companies within the same sector

Evaluate turnaround or distressed situations

Some value investors look for companies trading below book value, believing these stocks may be overlooked by the market. However, it is crucial to perform a deeper analysis, considering profitability, cash flow, growth prospects, and industry trends.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Where to Find Book Value Data

Book value per share is commonly reported on financial websites, in analyst reports, or directly from company filings. For hands-on investors, calculating it directly from the latest balance sheet ensures accuracy and transparency.

Popular financial data sources include:

Company annual and quarterly reports (10-K, 10-Q)

Financial news and data platforms such as Yahoo Finance, Bloomberg, and Morningstar

Brokerage platforms with research tools

Final Thoughts

Understanding how to determine a stock’s book value equips investors with a key analytical tool. While not the only measure of a company’s worth, it offers an important glimpse into the financial backbone of a business. Use book value as a starting point, but always dig deeper. Combine this measure with other tools, such as earnings analysis, cash flow, and an understanding of the company’s competitive position, for a more complete view.

Smart investors do not just take numbers at face value. They ask questions, seek context, and strive to understand the story behind the balance sheet.

Tendie Calculator

Book Value Calculator

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add