What is Fintech

- by:

- Nick H

Key Points

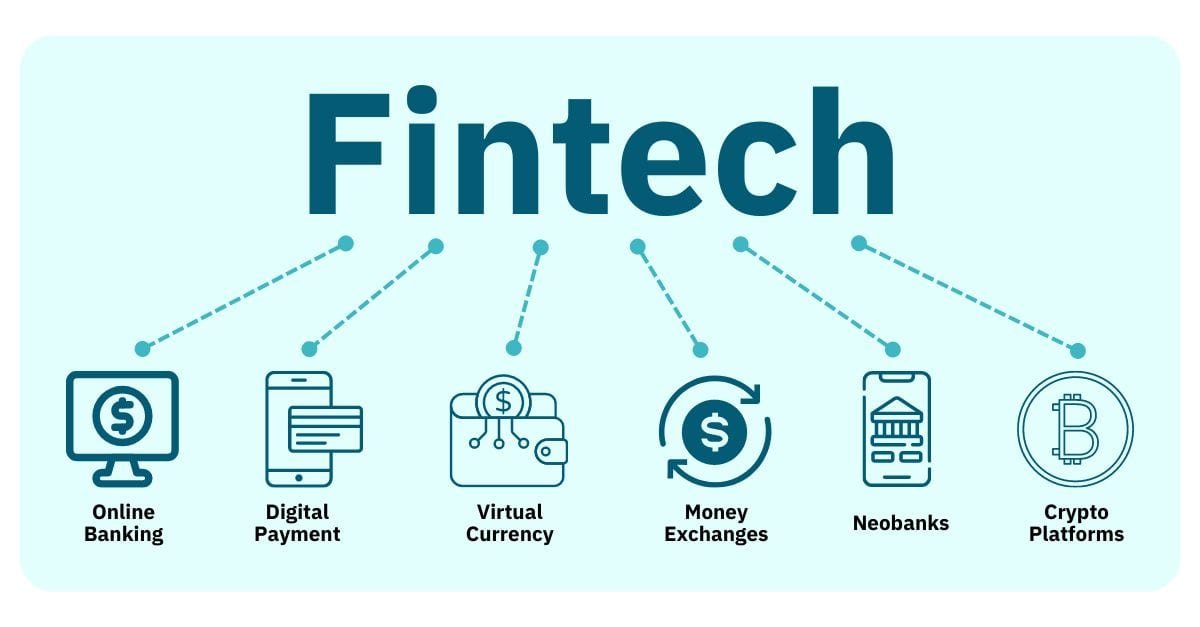

Fintech, short for financial technology, refers to the use of digital innovations to improve or automate financial services and processes

The fintech industry covers a wide range of sectors, including digital payments, online lending, robo-advisors, blockchain and cryptocurrencies

Fintech is transforming finance by increasing accessibility, lowering costs, enabling personalization, and empowering consumers

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

The Digital Revolution Transforming Finance

The term “fintech” has become a buzzword in recent years, reshaping everything from how people pay for coffee to how massive institutions manage risk and investment. Fintech stands for “financial technology,” a broad category that includes any technology-driven innovation in financial services. From mobile banking apps to blockchain, fintech is fundamentally changing the way money moves, how businesses operate, and how consumers interact with the financial system. But what exactly is fintech, and why does it matter so much today? Let’s break down this rapidly evolving field.

Defining Fintech

More Than Just Mobile Apps

Fintech refers to the use of technology to improve, streamline, or automate financial services and processes. It covers a vast range of products and platforms, from simple online payment tools to complex artificial intelligence systems that detect fraud or make investment decisions.

Key fintech segments include:

Payments and money transfers

Personal finance and budgeting apps

Lending and credit platforms

Robo-advisors and investment management

Insurtech (insurance technology)

Blockchain and cryptocurrencies

Regtech (regulatory technology)

What unites these innovations is their reliance on software, algorithms, and data to deliver faster, more convenient, and often more affordable financial solutions.

How Fintech Works

Technology at the Heart of Finance

Fintech companies leverage digital tools to solve problems that traditional banks and financial institutions often struggled to address. Cloud computing, artificial intelligence, big data analytics, and mobile connectivity are just a few of the technologies that have powered fintech’s rise.

Some core features of fintech solutions include:

Accessibility: Mobile devices and internet platforms allow users to manage finances from anywhere.

Automation: Algorithms can process transactions, approve loans, or rebalance investment portfolios with minimal human involvement.

Customization: Personalized recommendations and user experiences based on individual data and preferences.

Speed: Digital processes cut down wait times, whether sending money overseas or getting approved for a loan.

Most Like Articles

Why Fintech Matters

Disrupting and Democratizing Finance

Fintech is more than just a convenience—it is transforming the financial landscape by:

Increasing access: People who were once excluded from traditional banking, such as those in remote areas or with limited credit histories, can now use financial services through their phones.

Lowering costs: Digital platforms often have fewer overhead costs than brick-and-mortar banks, leading to more affordable services.

Fostering innovation: Startups and tech giants alike are competing to offer better solutions, driving rapid change.

Empowering consumers: Users have more control over their money and data, with tools to save, invest, and spend more wisely.

Fintech is also spurring competition that pushes established banks to upgrade their offerings, ultimately benefiting all consumers.

Key Areas of Fintech

From Payments to Robo-Advisors

Let’s look at a few of the most important sectors within fintech:

Digital Payments: Mobile wallets, peer-to-peer payment apps, and contactless payment technologies are making cashless transactions the new normal.

Online Lending: Platforms connect borrowers and lenders directly, often speeding up approvals and offering alternatives for those underserved by banks.

Robo-Advisors: Automated investment platforms use algorithms to create and manage portfolios, making investing accessible to those without large sums or financial expertise.

Blockchain and Cryptocurrencies: Decentralized digital ledgers and currencies, such as Bitcoin and Ethereum, are redefining concepts of money and trust in the financial system.

Insurtech: Technology is transforming insurance by streamlining claims, customizing policies, and improving risk assessment.

Regtech: Compliance and regulatory tasks are handled with automated tools, reducing costs and errors for financial firms.

Challenges and Risks in Fintech

Innovation Meets Oversight

Despite its many benefits, fintech brings its own set of challenges:

Security and privacy: Handling sensitive financial data makes fintech firms targets for cyberattacks and fraud.

Regulation: New business models often operate in legal gray areas, forcing regulators to adapt quickly.

Digital divide: Not everyone has access to the devices or connectivity needed to use fintech services.

Market volatility: Innovations like cryptocurrencies can experience dramatic price swings, presenting risk to users.

Responsible innovation and regulatory cooperation are essential for the continued growth and trust in fintech.

The Future of Fintech

Where is the Digital Finance Revolution Headed?

Fintech’s journey is far from over. Experts predict continued growth in areas such as:

Artificial intelligence: AI will play a bigger role in personal finance, investment, fraud detection, and customer service.

Open banking: Consumers can safely share their financial data across platforms, encouraging even greater innovation.

Embedded finance: Financial services will become seamlessly integrated into everyday apps, from ride-sharing to online shopping.

Global expansion: Fintech is reaching developing markets, bringing financial inclusion to millions who were previously unbanked.

Partnerships between tech startups, traditional banks, and regulators are likely to define the next chapter in fintech’s evolution.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

The Bottom Line: Why Fintech Matters for Everyone

Fintech is not just about flashy apps or cryptocurrencies—it is about making finance faster, smarter, and more accessible for everyone. Whether you are paying a friend, investing for retirement, or running a business, fintech is likely shaping your financial world behind the scenes.

Understanding fintech gives you a front-row seat to the digital revolution in money. As this field continues to grow, staying informed will help you take advantage of new tools and protect yourself in an increasingly digital financial landscape.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add