What is Accounts Payable

- by:

- Nick H

Key Points

Accounts payable represents short-term obligations a company owes to suppliers for goods and services received but not yet paid

Effective management of accounts payable directly impacts a company’s cash flow, working capital, and relationships with suppliers

A sudden change in accounts payable, without a clear operational reason, can signal cash flow stress, liquidity concerns, or potential supply chain issues

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

When evaluating a company’s financial health, most people focus on revenue, profit margins, and assets. Yet, hidden within the labyrinth of balance sheets lies a number that tells a powerful story: accounts payable. These figures, often overlooked by novice investors, offer a window into a company’s liquidity, supply chain relationships, and operational discipline. Whether you’re a student, a business leader, or a retail investor seeking an edge, understanding accounts payable is fundamental to decoding financial statements and making informed decisions.

Defining Accounts Payable: More Than Just Bills Owed

At its core, accounts payable represents the money a company owes to its suppliers for goods or services received but not yet paid for. This amount is listed as a current liability on the balance sheet, reflecting obligations that must typically be settled within a year. Unlike long-term debt or bonds, accounts payable is not a borrowing mechanism but rather the result of everyday business transactions.

In the day-to-day rhythm of commerce, companies purchase inventory, raw materials, utilities, and services on credit terms. Instead of handing over cash immediately, they receive an invoice from the supplier and agree to pay within a specific period, commonly thirty, sixty, or ninety days. The total value of these unpaid invoices at any given moment is the company’s accounts payable.

How Accounts Payable Works: A Real-World Example

Consider a manufacturer that sources steel and electronic components from various vendors. When it receives a shipment, it records the expense but does not pay instantly. Instead, the company’s accounting team enters the invoice into its accounts payable ledger, noting the due date and any terms such as early payment discounts or late payment penalties.

Suppose the company receives $100,000 worth of parts in April, with payment terms of net 60. These transactions are added to accounts payable. When payment is issued in June, accounts payable decreases by $100,000, and cash is reduced by the same amount.

This flow is constant. New invoices are added, payments are made, and the total balance fluctuates accordingly. The accounts payable department ensures that obligations are honored without straining cash flow or damaging supplier relationships.

The Role of Accounts Payable in the Financial Statements

Accounts payable is a fixture on the balance sheet, classified under current liabilities. Analysts and investors watch this number closely, as it reveals much about a company’s operating cycle and working capital management.

Here’s how it interacts with other financial metrics:

Cash Flow: Delaying payments increases cash on hand but can strain supplier relationships. Paying too quickly may forgo discounts or drain cash needed elsewhere.

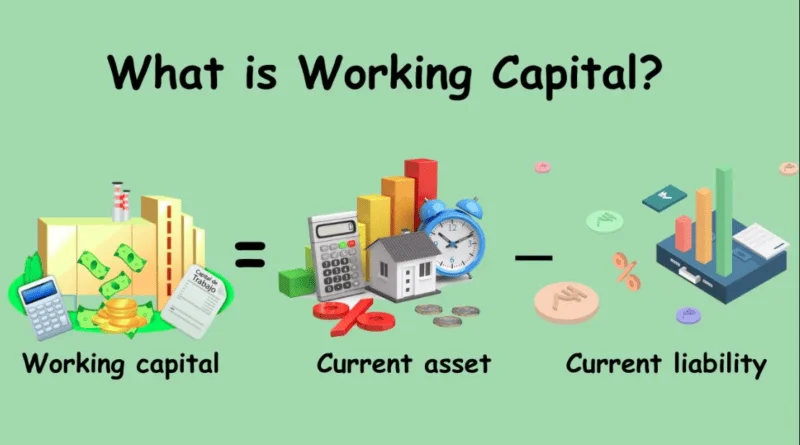

Working Capital: Accounts payable is subtracted from current assets to determine net working capital, a measure of short-term financial health.

Operating Cycle: High accounts payable may signal longer payment terms or a cash preservation strategy.

When reviewing the cash flow statement, look for “changes in accounts payable” within the operating activities section. An increase adds to operating cash flow, while a decrease signals payments have been made, reducing available cash.

Accounts Payable Versus Accounts Receivable

While accounts payable represents money owed to others, accounts receivable is the flip side: money owed to the company. Together, these two items illustrate the ebb and flow of cash in the supply chain.

Companies with strong negotiating power may extend their payable periods, holding onto cash longer. Conversely, fast-growing businesses may see payables spike as inventory and service needs grow.

For investors, analyzing both payables and receivables, and the ratio between them, reveals whether a company manages its obligations prudently or is at risk of liquidity stress.

Most Like Articles

Why Accounts Payable Matters to Investors

Accounts payable is not just an accounting formality. It carries significant strategic implications.

1. Liquidity Insight:

High accounts payable relative to assets or cash flow can signal pressure. Are payments being delayed because of tight finances? Or is the company simply optimizing its cash cycle?

2. Supplier Relationships:

Strong supplier relationships often translate to favorable credit terms. If a company routinely stretches its payment periods without penalty, it may have leverage or goodwill with suppliers. However, consistently overdue payables may damage trust and impact supply reliability.

3. Margin and Profitability:

Payables management can directly affect margins. Many suppliers offer early payment discounts, such as “2/10, net 30”—a two percent discount if paid in ten days. Savvy companies exploit these discounts, while less efficient firms leave money on the table.

4. Red Flags:

A sudden spike in accounts payable, without corresponding increases in assets or production, can be a warning. It may indicate cash shortages or trouble securing credit. Conversely, a sharp decline might mean the company is paying off suppliers too quickly, possibly sacrificing flexibility.

The Accounts Payable Process: From Invoice to Payment

Modern accounts payable is a multi-step process that combines administrative efficiency with financial control. Here’s an overview of how it works in practice:

1. Invoice Receipt:

The company receives an invoice from a vendor, either digitally or in print.

2. Three-Way Match:

Accounting teams match the invoice with the purchase order and receiving report. This “three-way match” ensures that the goods were ordered, received, and billed correctly.

3. Approval:

Invoices must be reviewed and approved according to internal controls. This might require sign-off from a department manager or finance officer.

4. Recording:

Once approved, the invoice is recorded as an account payable in the ledger.

5. Payment Scheduling:

Payments are scheduled according to terms. Some companies use automated systems to flag invoices for early payment discounts or to avoid late fees.

6. Payment Execution:

On the due date, payment is made via check, ACH transfer, or other means. The accounts payable balance is reduced accordingly.

7. Reconciliation:

The ledger is updated, and bank statements are reconciled to ensure accuracy.

Automation and software have revolutionized this process, reducing errors and streamlining approvals.

Measuring Accounts Payable: Key Metrics and Ratios

Several financial metrics help assess how well a company manages its payables:

Accounts Payable Turnover Ratio

This ratio measures how quickly a company pays its suppliers. It is calculated as:

Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable

A higher turnover ratio means the company pays suppliers quickly, while a lower ratio indicates longer payment periods.

Days Payable Outstanding (DPO)

DPO expresses the average number of days a company takes to pay its bills:

DPO = (Average Accounts Payable / Cost of Goods Sold) x Number of Days

A high DPO can be good for cash flow but might signal problems if it is out of sync with industry norms.

Working Capital Analysis

Working capital is current assets minus current liabilities, including accounts payable. Watching changes in accounts payable relative to inventory and receivables gives a snapshot of operational efficiency.

Accounts Payable in Different Industries

Payment practices vary widely by sector:

Retailers: May leverage accounts payable aggressively, especially with large supplier networks. Walmart, for example, has been known for negotiating long payment terms to conserve cash.

Manufacturers: Depend on timely payables management to maintain production. Delays can disrupt the entire supply chain.

Technology Firms: May have fewer payables due to digital product models but still manage significant vendor relationships, such as cloud services or licensing.

Understanding industry benchmarks is crucial when analyzing accounts payable ratios. What is efficient in retail might be concerning in healthcare or manufacturing.

Real-World Example: Accounts Payable at Apple

A look at Apple Inc. offers insight into the role of accounts payable in a global enterprise. Apple’s balance sheet regularly shows accounts payable figures in the tens of billions. This is not a sign of distress but a reflection of the company’s massive scale and negotiation power with suppliers. By extending payment terms, Apple optimizes cash flow while keeping its supply chain humming.

Investors and analysts monitor Apple’s accounts payable relative to inventory and sales. Any significant deviation could signal a shift in strategy or supply chain dynamics.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Common Challenges and Best Practices

Accounts payable management is rife with challenges. Fraud, duplicate payments, missed discounts, and late fees can erode profits. To counter these risks, leading companies embrace best practices:

Centralized Invoice Processing: Streamlines approvals and prevents lost invoices.

Automation and ERP Integration: Reduces errors and speeds up processing times.

Clear Payment Policies: Defines approval hierarchies and payment terms to avoid confusion.

Regular Reconciliation: Ensures that records match bank statements and supplier balances.

Supplier Communication: Maintains trust and flexibility, especially during cash flow crunches.

Accounts Payable and Corporate Strategy

The way a company manages its payables reflects broader strategic priorities. For some, stretching payment terms frees up capital for growth or investment. For others, paying quickly secures better terms or strengthens supplier loyalty.

During periods of economic uncertainty, accounts payable practices may shift. Companies may delay payments to conserve cash, a move that can ripple through supply chains. During expansions, prompt payment may become a competitive differentiator.

The Digital Transformation of Accounts Payable

Modern finance teams rely on technology to manage payables at scale. Cloud-based platforms and artificial intelligence are replacing paper invoices and manual entry. These solutions offer:

Real-Time Analytics: Immediate insight into payables trends and cash flow.

Fraud Detection: Automated checks flag suspicious invoices or unusual patterns.

Mobile Approvals: Executives can approve payments remotely, speeding up cycles.

Digital transformation not only improves efficiency but also enhances transparency, enabling smarter, faster decision-making.

Frequently Asked Questions About Accounts Payable

What happens if accounts payable is not managed properly?

Poor management can result in late fees, damaged supplier relationships, lost discounts, and even legal action. In extreme cases, it can disrupt operations or threaten a company’s survival.

How does accounts payable impact stock prices?

While payables themselves rarely move stock prices, significant changes can indicate broader trends. A spike in payables might raise questions about liquidity, while steady management supports confidence in operations.

Can investors see accounts payable details in public filings?

Yes, publicly traded companies disclose accounts payable on their balance sheets. The notes to financial statements may also offer detail on payment terms and supplier concentrations.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add