What is a Spread

- by:

- Nick H

Key Points

A spread refers to the difference between two financial values, such as prices, interest rates, or yields

The bid-ask spread is the gap between the price buyers are willing to pay and the price sellers will accept for a security

Yield spreads and credit spreads are used in the bond market to compare returns and assess risk between different types of debt

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

Unraveling One of Finance’s Most Versatile Terms

In the world of finance, the term “spread” is everywhere. From stock trading floors to bond markets and even at your local bank, spreads play a central role in how markets function and how money moves. Yet, the meaning of a spread changes depending on the context, making it one of the most versatile and important concepts in finance. In this guide, you will learn exactly what a spread is, why it matters, and how it influences the decisions of investors, traders, and financial institutions every day.

Defining the Spread

The Difference that Makes a Market

At its core, a spread is simply the difference between two prices, rates, or yields. It acts as a measure of separation, whether between what buyers will pay and what sellers will accept, or between the returns on different types of financial instruments.

Spreads are found in nearly every corner of finance. Some of the most common forms include:

Bid-Ask Spread: The gap between the price buyers are willing to pay (bid) and the price sellers want to receive (ask) for a security.

Yield Spread: The difference in yields between two bonds or fixed-income securities, often used to compare risk or market expectations.

Credit Spread: The extra yield investors demand to hold a bond with credit risk over a risk-free government bond.

Option Spread: In options trading, it refers to strategies involving the simultaneous buying and selling of different options contracts to capture price differences.

Bid-Ask Spread

The Heartbeat of Trading Activity

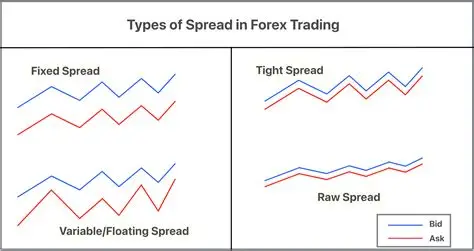

The most commonly discussed spread is the bid-ask spread. Every time you buy or sell a stock, bond, or currency, you encounter this spread.

Bid is the highest price a buyer is willing to pay for an asset.

Ask (or offer) is the lowest price a seller is willing to accept.

The difference between the two is the bid-ask spread. This spread represents the transaction cost to investors and the profit opportunity for market makers. Highly traded securities, such as major stocks or currencies, usually have narrow spreads, while less liquid assets often show wider spreads.

Yield Spread

Comparing Returns Across Fixed-Income Investments

In the bond market, the yield spread helps investors compare returns between different bonds. For example, the spread between corporate bonds and government bonds of the same maturity reflects the additional compensation investors require for taking on extra risk.

Positive Spread: The bond with more risk pays a higher yield than a safer bond.

Negative or Inverted Spread: Occasionally, riskier bonds may offer lower yields, which can signal unusual market conditions or expectations.

Yield spreads can also show expectations for economic trends, such as inflation or changes in interest rates.

Most Like Articles

Credit Spread

Assessing Risk and Reward in Bond Markets

Credit spread is a specific type of yield spread, showing the difference in yield between a corporate bond and a government bond of similar maturity. It serves as a key indicator of credit risk.

A widening credit spread often signals rising concern about a borrower’s ability to repay, while a narrowing spread suggests improved creditworthiness. Investors and analysts closely monitor credit spreads to assess market sentiment and financial stability.

Spreads in Options and Derivatives

Strategies Built on Differences

Spreads are also central to options trading. Here, a spread can refer to any strategy that involves holding two or more option positions with different strike prices or expiration dates.

Vertical Spread: Buying and selling options of the same type and expiration but at different strike prices.

Horizontal (or Calendar) Spread: Buying and selling options with the same strike price but different expiration dates.

Diagonal Spread: A combination of different strike prices and expiration dates.

These strategies are used to manage risk, reduce costs, or speculate on market movements with more precision.

Other Types of Spreads in Finance

Beyond the Basics

There are many specialized spreads in the financial world:

Swap Spread: The difference between the fixed rate of a swap and the yield of a government bond.

Interbank Spread: The difference between lending and borrowing rates among banks.

Spread in Banking: The gap between what a bank pays on deposits and what it earns from loans.

Each spread gives insight into pricing, profitability, and market conditions in its particular context.

Why Spreads Matter

Signals, Costs, and Profit Opportunities

Understanding spreads is essential because they:

Indicate market liquidity and efficiency.

Reflect transaction costs for buyers and sellers.

Serve as signals of risk, sentiment, or expected changes in the economy.

Provide profit opportunities for traders and institutions.

Narrow spreads usually indicate active, competitive markets. Wide spreads may signal lower liquidity, higher risk, or increased uncertainty.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Real-World Example of a Spread

Bringing the Concept to Life

Suppose you are interested in buying shares of a company. The bid price is $50.00 and the ask price is $50.05. The bid-ask spread is $0.05 per share. If you buy at the ask and immediately sell at the bid, you would lose $0.05 per share—this is the spread cost.

In the bond market, if a U.S. Treasury bond yields 2 percent and a similar corporate bond yields 3 percent, the yield spread is 1 percent, reflecting the extra risk investors take on with the corporate bond.

The Bottom Line: Spreads as Financial Barometers

Spreads are more than just technical jargon; they are vital tools for anyone navigating financial markets. They shape the cost of transactions, highlight risks and opportunities, and offer clues about market sentiment and economic trends.

Whether you are investing in stocks, evaluating bonds, or considering options strategies, a solid grasp of spreads will give you deeper insight into the mechanics of markets and the true cost and reward of your investment decisions.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add