What is a Escrow

- by:

- Nick H

Key Points

Escrow is an arrangement where a neutral third party holds funds, assets, or property during a transaction

Escrow protects both buyers and sellers in various transactions, including real estate, business deals, online sales, and construction projects

Escrow provides security, reduces risk of fraud or default, and ensures professional oversight

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

Escrow is a fundamental concept in finance, real estate, investing, and business transactions. It refers to an arrangement where a neutral third party holds assets, funds, or property on behalf of two other parties involved in a transaction. The third party, known as the escrow agent, only releases the assets when all agreed-upon conditions of the transaction have been met. Escrow services are designed to protect the interests of both buyers and sellers, ensuring that each side fulfills its contractual obligations before the exchange is completed.

Understanding escrow is crucial for anyone participating in large financial transactions, real estate deals, online sales, or mergers and acquisitions. The use of escrow adds an important layer of security and trust to complex deals, reducing the risk of fraud or default.

The Role of Escrow in Transactions

The primary purpose of escrow is to safeguard the interests of all parties by acting as a trusted intermediary. In a typical transaction, the buyer wants to ensure that their payment is secure and will only be transferred if the seller meets all the terms. The seller, on the other hand, wants assurance that the buyer has the funds and is committed to completing the purchase. By depositing the assets or funds into escrow, both sides can proceed with confidence, knowing the transaction will not be finalized unless every step is fulfilled.

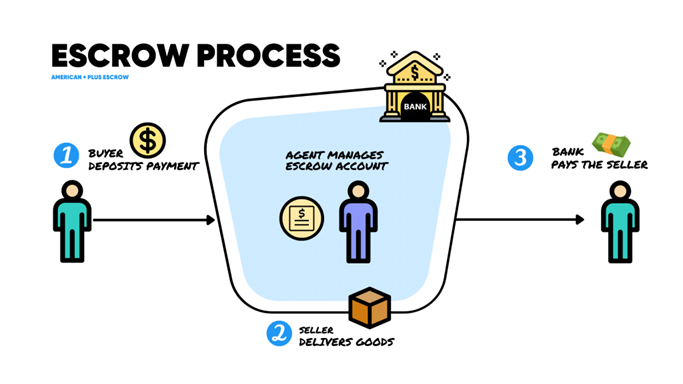

How Escrow Works

The process begins when both parties agree to the terms of the deal and engage an escrow service. The buyer submits payment or assets into the escrow account. The seller provides the agreed goods, services, or property, or takes the necessary actions specified in the contract. The escrow agent verifies that all conditions have been satisfied, then releases the funds or assets to the seller. If either party fails to meet the terms, the escrow agent returns the funds or property to the rightful owner according to the contract.

Most Like Articles

Common Uses of Escrow

Escrow is a versatile arrangement used in many different contexts, each with its own unique procedures and safeguards. Some of the most common uses include:

Real Estate Transactions

Perhaps the most familiar use of escrow occurs in real estate. When someone buys a home, the buyer typically deposits their earnest money and eventually their down payment into an escrow account. The escrow agent holds this money until all steps in the sale—such as home inspections, title searches, and final approvals—are completed. The escrow company then distributes the funds to the seller and pays off any existing mortgages or liens. This process protects both buyer and seller from unexpected problems or last-minute changes.

Stock and Securities Deals

In mergers, acquisitions, or the sale of business assets, escrow is used to hold shares, cash, or documents until all closing conditions have been met. This ensures that neither side can back out without consequence and that all legal and financial requirements are properly addressed.

Online and E-Commerce Transactions

Online escrow services are popular in situations where buyers and sellers do not know each other. For example, a buyer purchasing expensive electronics or collectibles from a stranger may use an escrow service to hold payment until the goods are received and verified. If the buyer is satisfied, the money is released to the seller. If not, the escrow service returns the payment to the buyer.

Construction and Development Projects

Escrow accounts are also used in construction to hold funds for specific stages of a project. Payments are released as certain milestones or inspections are completed, ensuring that contractors are paid fairly and that project owners receive work as promised.

Rental Security Deposits

Landlords sometimes use escrow to hold tenants’ security deposits. This arrangement ensures that the funds are available for return or for covering damages at the end of the lease, depending on the condition of the property.

The Escrow Agent’s Responsibilities

The escrow agent or company plays a critical role as a neutral intermediary. Their responsibilities include:

Receiving and holding funds, documents, or property securely

Verifying that all contract terms and conditions have been satisfied

Communicating with all parties to ensure transparency

Releasing assets only when all parties have fulfilled their obligations

Providing a clear accounting of all funds or assets held in escrow

The agent must remain impartial and follow the instructions outlined in the escrow agreement. In some industries, escrow agents are subject to licensing and regulatory requirements to ensure they adhere to professional standards.

Advantages of Escrow

The use of escrow brings several key benefits:

Security and Trust

By involving a neutral third party, both sides are protected from fraud, misrepresentation, or failure to deliver.

Reduced Risk

Funds or property are not exchanged until all terms have been met, reducing the chance that one side will default or walk away.

Professional Oversight

Escrow agents provide oversight and ensure that the process is conducted according to the agreement.

Dispute Resolution

If disagreements arise, the escrow agent follows the contract terms to determine how assets should be distributed or returned.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Disadvantages and Considerations

While escrow offers strong protections, it is not without drawbacks:

Escrow services can involve fees, which are sometimes split between parties or paid by one side.

The process may take longer than a direct transaction, especially if there are complex conditions or legal requirements.

All parties must trust the escrow agent to act fairly and competently.

Choosing a reputable escrow company is crucial to avoiding problems or delays.

How to Set Up an Escrow Arrangement

Setting up escrow typically involves these steps:

Both parties agree on the terms of the transaction and select an escrow agent or service.

The escrow agent drafts an escrow agreement, specifying all requirements for the release of funds or assets.

The buyer deposits funds, or the seller deposits assets or documents, into the escrow account.

The agent holds these until all conditions are met, communicating progress to both sides.

Upon verification, the escrow agent distributes the funds or assets according to the agreement.

Escrow in Investing and Business

Beyond real estate, escrow is widely used in investment transactions. In initial public offerings, funds raised from investors may be held in escrow until shares are allotted. Venture capital deals may use escrow to hold funds while performance milestones are being met. In cross-border transactions, escrow ensures that assets can be safely exchanged even if the parties operate in different legal jurisdictions.

The Importance of Escrow in Modern Finance

Escrow arrangements have become a foundation of modern finance because they provide essential protection and facilitate trust in high-value or high-risk transactions. Whether buying a home, selling a business, or conducting a large investment deal, escrow can help prevent losses and ensure that everyone fulfills their promises.

Understanding how escrow works empowers individuals and businesses to make safer, more informed financial decisions. It is an essential tool for anyone who wants to reduce risk and build trust in any major transaction.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add