Put Options

- by:

- Nick H

Key Points

Put options give the right to sell stock at a set price

Investors use puts for hedging, speculation, and income

Strategies range from basic protective puts to advanced spreads

what is a call option

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

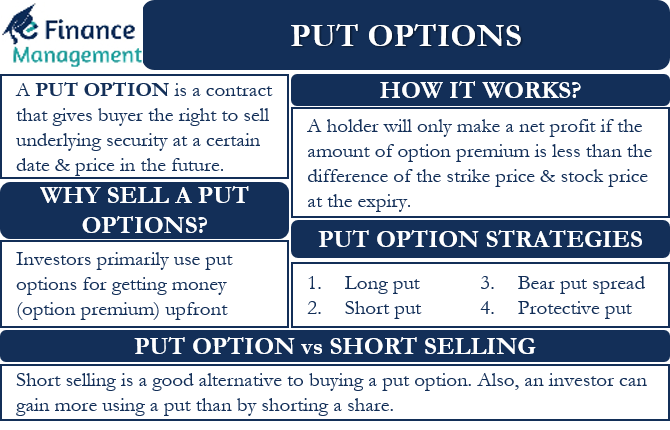

Put options are a cornerstone of modern options trading and risk management. Many investors first encounter the concept when looking for ways to protect their portfolios or profit from a falling market. Understanding put options opens up a world of strategies that go beyond basic stock buying and selling.

What Is a Put Option?

A put option is a financial contract that gives its holder the right, but not the obligation, to sell a specified amount of an underlying stock at a predetermined price within a fixed time period. This predetermined price is known as the strike price. Each standard options contract typically covers 100 shares of the underlying stock. The right to sell at the strike price is valid until the option’s expiration date. The buyer of a put option pays a premium up front for this right.

How Put Options Work

When you purchase a put option, you are essentially securing the right to sell the underlying stock at the strike price before the option expires. If the stock price drops below the strike price, the value of the put option increases. This is because you can buy the stock at the lower market price and sell it at the higher strike price, pocketing the difference.

For example, suppose you buy a put option for Company ABC with a strike price of $50 and an expiration in one month. If ABC’s stock falls to $40, your put option allows you to sell shares at $50, even though the market is only offering $40. This built-in advantage is why put options are often seen as insurance for stock portfolios.

Why Use Put Options?

Investors and traders use put options for several reasons:

Hedging: The most common use is to protect existing stock positions from potential losses. By purchasing a put option, you can limit your downside if the stock price declines.

Speculation: Traders use puts to profit from expected downward moves in a stock’s price. Since puts rise in value when the stock falls, they are a tool for betting against a company or the market.

Income Generation: Selling (writing) put options is a way to collect premium income, especially when you are willing to buy the stock at a lower price.

Every Put Option Strategy

Put options are versatile. Here are several widely used strategies involving puts:

Protective Put

A protective put involves buying a put option while holding shares of the underlying stock. This strategy acts as insurance, limiting your downside risk if the stock price falls. The put increases in value as the stock declines, offsetting losses.

Long Put

A long put means buying a put option on a stock you do not own. This strategy profits directly from a drop in the stock price. The maximum risk is the premium paid for the put, while the reward increases as the stock price falls.

Cash-Secured Put

Selling a cash-secured put involves writing a put option while holding enough cash to buy the stock if assigned. You earn premium income for taking on the obligation to buy shares at the strike price. This strategy is used to acquire shares at a discount or generate steady income.

Naked Put

A naked put is selling a put option without holding cash or stock as collateral. This strategy carries unlimited downside risk, as you may be forced to purchase shares at the strike price regardless of how far the stock falls. Traders use naked puts to collect premium, but it requires high risk tolerance.

Bear Put Spread

The bear put spread involves buying a put option at a higher strike and selling another put at a lower strike with the same expiration. This creates a limited-risk bearish position that profits from moderate declines in the stock. The cost of the trade is reduced by the premium received from the sold put.

Ratio Put Write

A ratio put write consists of selling more put options than you buy, such as selling two puts for every one you buy. This strategy can generate higher premium income, but if the stock falls sharply, your losses can increase quickly. It is a high-risk, high-reward approach best left to experienced traders.

Put Backspread

The put backspread is constructed by selling one put at a higher strike and buying two or more puts at a lower strike. This trade profits from significant downward moves in the stock price, as the long puts will more than offset the loss from the short put. If the stock remains flat or rises, you risk losing the initial premium paid.

Married Put

A married put is when you buy a put option and purchase an equal number of shares of the underlying stock at the same time. This sets a clear floor for losses, as the put will increase in value if the stock drops. It is often used by investors seeking protection right after entering a stock position.

Collar

A collar strategy combines owning the stock, buying a protective put, and selling a covered call at a higher strike price. The put limits downside risk, while the call helps offset the cost by generating premium income. This approach is used to protect gains or limit losses while capping potential upside.

Long Straddle

A long straddle involves buying both a put and a call at the same strike price and expiration. This strategy bets on increased volatility, profiting from big moves in either direction. The main risk is if the stock remains flat, causing both options to lose value.

Long Strangle

A long strangle is similar to a straddle, but the put and call have different strike prices, both out of the money. This approach costs less than a straddle but requires a larger move in the stock price to be profitable. It is used to capitalize on anticipated volatility.

Short Put Spread (Bull Put Spread)

The short put spread involves selling a put at a higher strike and buying another put at a lower strike. This creates a limited-risk bullish position, collecting premium if the stock stays above the higher strike. The risk is capped at the difference between strike prices minus the net premium received.

Put Ladder

A put ladder involves buying and selling puts at several different strike prices to customize the risk and reward profile. This strategy can be tailored for complex market views and allows for creative combinations of income and protection. The payoff diagram can be structured for maximum flexibility.

Synthetic Short Stock

A synthetic short stock position is created by buying a put and selling a call at the same strike and expiration. This mimics the payoff of shorting the actual stock, profiting from price declines. The risk is theoretically unlimited if the stock rises significantly.

Put Calendar Spread

The put calendar spread involves selling a short-term put and buying a longer-term put at the same strike price. This strategy aims to profit from time decay on the near-term option and potential volatility changes. It is often used when you expect the stock to remain stable in the short term but decline over a longer period.

Put Diagonal Spread

A put diagonal spread combines buying and selling puts at different strikes and expirations. This approach lets you take advantage of both price movements and changes in volatility across time. The diagonal spread provides greater flexibility in adjusting to evolving market conditions.

Risks of Put Options

Put options carry risk. If the stock price stays above the strike price, the option will expire worthless and the premium paid is lost. Selling put options exposes you to the risk of having to buy shares at the strike price, which could be much higher than the current market price if the stock falls sharply.

Options are powerful but require education and discipline. Always understand the potential outcomes before entering a trade, and avoid risking more than you can afford to lose.

Conclusion

Put options are essential for anyone serious about risk management and strategic trading. Whether you are protecting gains, seeking to profit from falling prices, or looking for creative ways to generate income, put options offer flexibility that regular stock trading does not provide. Mastering puts adds a valuable layer to your investing toolbox and helps you navigate any market condition with more confidence.

For adsense add