What is Goodwill

- by:

- Nick H

Key Points

Goodwill is an intangible asset recorded when one company acquires another for a price above the fair value of its net identifiable assets

Unlike physical assets, goodwill cannot be independently sold or seen, but it can significantly influence a company’s balance sheet

Goodwill is calculated by subtracting the fair value of net identifiable assets from the purchase price paid for a business; any excess amount is recorded as goodwill

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

The Hidden Asset: What Is Goodwill?

Goodwill is one of those financial terms that sounds simple but is layered with nuance. At its core, goodwill represents the intangible value a company acquires when it purchases another business for a price higher than the fair value of its net identifiable assets. Unlike physical assets such as buildings or machinery, goodwill is invisible and cannot be seen or touched. However, its impact on a company’s balance sheet can be significant, especially in the world of mergers and acquisitions.

Where Does Goodwill Come From?

To truly understand goodwill, it helps to consider how businesses are valued during an acquisition. When one company acquires another, it pays a certain price to purchase all assets and assume liabilities. The acquiring company first calculates the fair market value of all identifiable assets, including both tangible assets like equipment and inventory and identifiable intangible assets such as patents, copyrights, and trademarks. The liabilities, such as debts and obligations, are then subtracted from the asset total to determine net identifiable assets.

Often, the price paid by the acquiring company exceeds this net value. The difference is what is recorded as goodwill. This extra payment is essentially for qualities that are not easily measured but add significant value to a business. Examples include strong brand recognition, loyal customers, experienced management, proprietary technology, or a desirable location.

Breaking Down the Calculation: How Is Goodwill Measured?

Let’s break it down with a straightforward example. Suppose Company A acquires Company B for $10 million. Company B’s net identifiable assets—after subtracting all debts and liabilities from all assets—are valued at $7 million. The excess amount paid, which is $3 million, will be recorded as goodwill on Company A’s balance sheet.

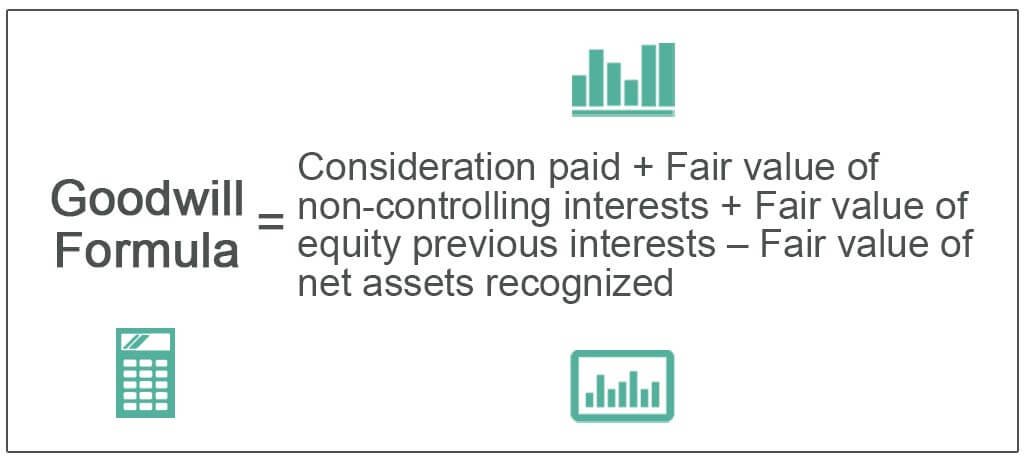

The formula looks like this:

Goodwill = Purchase Price – Fair Value of Net Identifiable Assets

This calculation ensures that all the tangible and separately identifiable intangible assets are properly valued before the “extra” is classified as goodwill.

Most Like Articles

The Many Faces of Goodwill: What Does It Represent?

Goodwill is often described as the “secret sauce” of a business. While it is not something you can touch or independently sell, it often plays a crucial role in a company’s long-term success and profitability. Here are some of the elements that goodwill may represent:

Brand Reputation: A business with a strong reputation can command higher prices and retain loyal customers.

Customer Relationships: Repeat business and customer loyalty can be extremely valuable but are difficult to quantify.

Employee Morale and Experience: An experienced, talented, and motivated workforce can set a company apart from its competition.

Synergies and Market Position: The combined strengths of the two companies may create efficiencies or open new markets that could not be achieved alone.

Accounting for Goodwill: What Happens After Acquisition?

Once goodwill is recognized on the balance sheet, the story does not end there. In earlier accounting practices, goodwill was amortized, meaning it was gradually reduced in value over a set period. However, today’s standards, especially under generally accepted accounting principles (GAAP) in the United States and International Financial Reporting Standards (IFRS), have changed that approach.

Now, goodwill is not amortized but instead tested annually for impairment. Impairment occurs when the carrying value of goodwill exceeds its fair value, often due to changes in business circumstances such as declining profits, market disruptions, or increased competition. If impairment is found, the company must reduce the value of goodwill on its balance sheet and record a loss in the income statement.

This process ensures that the value recorded for goodwill remains relevant and does not overstate a company’s assets. It also highlights the importance of regularly reassessing the factors that contributed to goodwill in the first place.

Why Goodwill Matters for Investors

For investors, goodwill can be a double-edged sword. On the positive side, a significant goodwill figure may indicate that the acquired business brought strong intangible assets to the table, such as a powerful brand, a valuable customer base, or innovative intellectual property. These can translate into lasting competitive advantages.

On the flip side, excessive or growing goodwill can be a warning sign. If a company regularly pays much more than the fair value of acquired assets, it might suggest overpayment, poor acquisition decisions, or aggressive accounting. A major goodwill impairment can signal trouble and lead to large, unexpected losses, impacting the stock price.

It is also important to compare goodwill to total assets or equity. If goodwill makes up a large proportion of total assets, investors may want to investigate the company’s acquisition strategy and the underlying reasons for such a high value.

Real-World Examples: Goodwill in Action

Let’s take a look at how goodwill plays out in the real world. When a tech giant acquires a smaller software company, the purchase price is often much higher than the book value of the acquired company’s physical assets. The buyer is paying for the acquired company’s innovative technology, loyal user base, and growth potential—none of which appear as physical items on the balance sheet.

Another example is in the consumer goods industry. When a major corporation acquires a trendy brand with massive customer loyalty, much of the purchase price is attributed to the goodwill arising from that brand’s reputation and market presence.

However, goodwill can also take a hit. Several large companies have faced massive write-downs of goodwill due to failed acquisitions or deteriorating business conditions, resulting in billions in lost value. These events can be cautionary tales for investors and company leaders alike.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

The Challenges of Valuing Goodwill

Despite its importance, valuing goodwill is not straightforward. Since goodwill represents intangibles, there is always a degree of subjectivity involved. This subjectivity can sometimes result in disputes or differing opinions between management, auditors, and regulators.

There is also a risk that management may be tempted to overstate goodwill or make overly optimistic projections when justifying an acquisition. This is why auditors and investors pay close attention to the methods and assumptions used in the valuation process and to subsequent impairment tests.

Goodwill Beyond Business Combinations

Although goodwill is most often discussed in the context of mergers and acquisitions, the concept has broader implications. In daily business operations, a company’s goodwill, while not recorded on the balance sheet, is still a vital asset. Building goodwill with customers, suppliers, and employees can lead to long-term relationships, repeat business, and positive word-of-mouth.

Companies invest heavily in marketing, customer service, and corporate social responsibility to build and maintain this goodwill. While these efforts may not always be reflected directly in the financial statements, their long-term impact can be substantial.

Final Thoughts: Goodwill as a Strategic Asset

Goodwill is much more than an accounting entry. It is a reflection of the non-physical factors that make a business successful. Understanding how goodwill is created, measured, and managed helps investors, managers, and students of finance better appreciate the complexities of business valuation and strategy.

By recognizing the many forms goodwill can take and the risks involved in its assessment, investors can make more informed decisions and spot potential red flags. For business leaders, focusing on building and sustaining goodwill can create real and lasting value that goes far beyond what is visible in the financial statements.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add