What is Working Capital

- by:

- Nick H

Key Points

Working capital is the difference between a company’s current assets and current liabilities

Positive working capital means a business can pay its bills and fund daily operations

Efficient working capital management involves balancing incoming cash from receivables, controlling inventory levels, and managing outgoing payments

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

The Lifeblood of Day-to-Day Business Operations

Working capital is one of the most vital measures in business finance. It is the financial fuel that keeps daily operations running smoothly, pays the bills, and supports growth. Whether you are managing a global corporation or a small local business, understanding working capital is crucial for making informed decisions. In this guide, we will break down what working capital is, how it is calculated, why it matters, and how it can be managed to maximize business success.

Defining Working Capital

A Simple Formula with Powerful Implications

At its core, working capital represents the difference between a company’s current assets and current liabilities. It measures the resources available to fund day-to-day activities and meet short-term obligations.

The basic formula is:

Working Capital = Current Assets – Current Liabilities

Current assets include cash, accounts receivable, inventory, and other resources expected to be converted to cash within one year.

Current liabilities are debts or obligations due within the same period, such as accounts payable, short-term loans, and accrued expenses.

A positive working capital means a business can cover its short-term debts and still have resources left over, while negative working capital can signal potential trouble ahead.

Why Working Capital Matters

More Than Just a Number

Working capital is often called the lifeblood of a business. Without enough working capital, even a profitable company can run into trouble paying suppliers, covering payroll, or managing unexpected expenses.

Key reasons why working capital is so important:

Liquidity: It ensures the business can pay its bills on time and avoid financial distress.

Flexibility: Adequate working capital lets a business take advantage of new opportunities, such as bulk purchasing discounts or investing in growth.

Stability: It acts as a buffer against financial surprises, such as late-paying customers or sudden drops in sales.

Investors, lenders, and managers closely watch working capital as a sign of a company’s short-term financial health and operational efficiency.

Most Like Articles

Components of Working Capital

Breaking Down the Key Elements

To fully understand working capital, it is helpful to look at its two main components:

Current Assets:

Cash and Cash Equivalents: The most liquid resources, ready for immediate use.

Accounts Receivable: Money owed by customers for goods or services already delivered.

Inventory: Raw materials, work-in-progress, and finished goods ready to be sold.

Other Short-Term Assets: Prepaid expenses, short-term investments, or other assets expected to be used or received within a year.

Current Liabilities:

Accounts Payable: Amounts owed to suppliers for purchases on credit.

Short-Term Loans and Notes Payable: Borrowings that must be repaid within a year.

Accrued Expenses: Costs that have been incurred but not yet paid, such as wages or utilities.

Other Short-Term Liabilities: Taxes payable, current portions of long-term debt, and similar obligations.

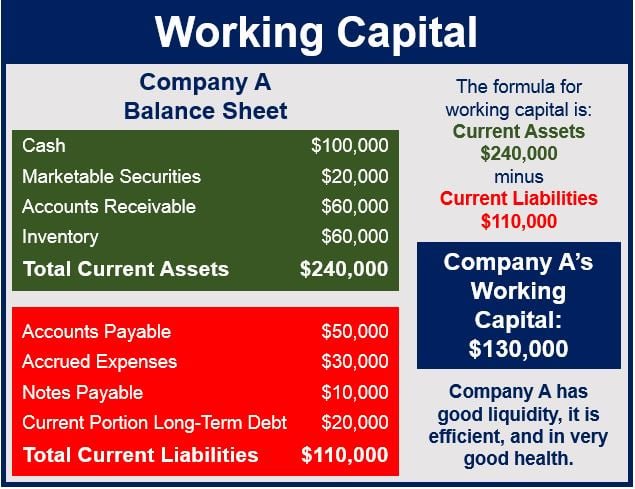

Calculating and Interpreting Working Capital

What the Numbers Tell You

Calculating working capital is straightforward, but interpreting the results requires context:

Positive Working Capital: The company has more short-term assets than liabilities, indicating financial stability.

Negative Working Capital: Short-term obligations exceed available resources, potentially signaling liquidity problems.

Zero Working Capital: Assets and liabilities are perfectly balanced, but this can be risky, leaving no cushion for unexpected events.

A healthy level of working capital depends on the industry, company size, and business model. For example, retailers often need more working capital due to large inventories, while service businesses may need less.

Managing Working Capital Effectively

Strategies for Success

Efficient working capital management is a balancing act. Too little can lead to missed payments or lost opportunities, while too much might mean idle resources that could be put to better use.

Common strategies to optimize working capital include:

Speeding Up Receivables: Encouraging customers to pay sooner through discounts or better terms.

Managing Inventory: Keeping enough stock to meet demand without over-investing in slow-moving items.

Stretching Payables: Taking advantage of full payment terms without damaging supplier relationships.

Controlling Expenses: Monitoring costs and finding efficiencies in daily operations.

Smart working capital management helps businesses maintain liquidity, invest in growth, and weather economic downturns.

Working Capital in Financial Analysis

A Key Indicator for Investors and Lenders

Investors and lenders use working capital to gauge a company’s operational strength and risk. A consistently low or negative working capital could mean the company is struggling, while excess working capital might suggest inefficient use of resources.

Working capital ratios, such as the current ratio (current assets divided by current liabilities), provide further insight into a company’s liquidity. A ratio above 1.0 generally signals good short-term financial health.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Real-World Example of Working Capital

Bringing the Concept to Life

Suppose a technology distributor has $300,000 in current assets and $180,000 in current liabilities. Its working capital would be:

$300,000 – $180,000 = $120,000

This positive working capital means the company can comfortably pay its short-term bills and still have funds available to invest in inventory, technology upgrades, or expansion.

The Bottom Line: Why Working Capital Matters for Every Business

Working capital is not just a line on the balance sheet—it is a window into the health, efficiency, and resilience of any company. It measures a business’s ability to pay its way, grab new opportunities, and keep operations running smoothly.

By monitoring and managing working capital, business owners, investors, and financial professionals can spot potential problems early, make better decisions, and drive sustainable growth. Whether you are analyzing a stock, running a startup, or planning your next investment, understanding working capital is essential for success.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add