What Are Stock Options

- by:

- Nick H

Key Points

Stock options are contracts, not actual shares

Options trading offers leverage and flexibility

Education and risk management are essential for beginners

what is a put option

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

Stock options are one of the most misunderstood tools in the world of investing and trading. Many new investors hear about options trading, but quickly get overwhelmed by the terms and strategies. In reality, stock options are not as mysterious as they seem. With a clear explanation and a little practice, any investor can learn how options work and how they can be used to manage risk, speculate on price movements, or even generate extra income.

This beginner’s guide will walk you through the basics of stock options, explain the difference between call options and put options, cover important terminology, and give you a solid foundation for understanding options trading. Whether you are just starting your investment journey or looking to expand your stock market knowledge, this guide is designed to help you feel confident about options.

What Are Stock Options?

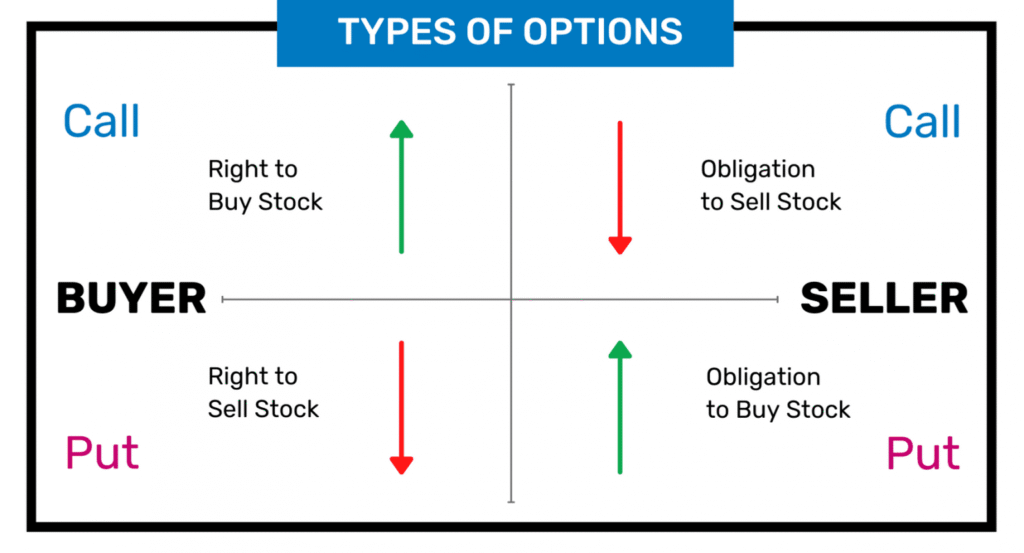

A stock option is a contract that gives you the right, but not the obligation, to buy or sell a specific number of shares (usually 100 per contract) of a stock at a certain price before a specified expiration date. Options are traded on public exchanges just like stocks, and they have their own pricing, liquidity, and risk factors. Unlike simply buying or selling shares of stock, options trading allows you to use leverage, create unique strategies, and manage risk in ways that traditional investing does not offer.

How Do Stock Options Work?

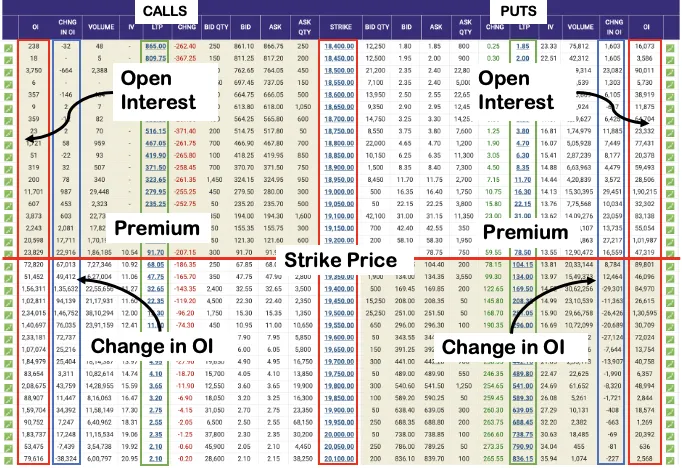

When you buy a stock option, you are purchasing a contract. This contract lets you decide whether you want to buy or sell the underlying stock at a predetermined price, which is called the strike price. Every option also has an expiration date, which is the last day you can use the contract. After this date, the option becomes worthless.

Options trading can be used for many different reasons. Some investors use options to hedge their portfolios against losses, others use them to speculate on the direction of a stock’s price, and some generate income by selling options contracts.

Call Options: Your Ticket to Potential Upside

A call option is a contract that gives you the right to buy a stock at a specific strike price before the option’s expiration date. Investors purchase call options when they believe a stock’s price will rise. The logic is simple: if the stock climbs above your strike price, you can buy the shares at a lower price and either sell them for a profit or continue to hold them. The most you can lose is the amount you paid for the option, called the premium.

For example, let’s say you buy a call option for Company XYZ with a strike price of $50, an expiration date one month from now, and a premium of $2 per share. If XYZ’s stock price rises to $60, you can exercise your option and buy the shares at $50 each, then sell them on the open market for $60, capturing the difference as profit (minus the premium you paid). If the stock never reaches $50, your option expires, and you only lose the premium.

Call options are used in bullish options strategies, such as buying calls or selling covered calls. They can be a cost-effective way to bet on rising stock prices, since you only need to pay the premium rather than the full price of 100 shares.

Put Options: Profiting from Downside Moves or Protecting Your Portfolio

A put option is a contract that gives you the right to sell a stock at a specific strike price before expiration. Investors buy put options when they think a stock’s price will decline. If the stock drops below the strike price, you can sell the shares at a higher price than the market offers, which can help offset losses or even produce a profit.

Suppose you own shares of Company ABC, and you are worried the price might fall. You can buy a put option with a strike price near the current price. If the market drops, your put option increases in value, which can offset some or all of the loss on your shares. This technique is called hedging and is often used by investors to manage risk.

Put options are also popular with traders who want to profit from falling stocks. You can buy puts outright, or combine them with other options to create advanced options strategies, such as protective puts or bear spreads.

Why Trade Stock Options?

Options trading offers several advantages for investors and traders:

Leverage

With a relatively small amount of money, you can control a much larger position in the stock market. This can lead to bigger potential returns, but also increases your risk.

Flexibility

Options can be combined in countless ways to create strategies for almost any market condition.

Risk Management

Options can be used to hedge against potential losses in your portfolio.

Income Generation

Investors can sell options contracts to collect premiums, which provides extra income.

Risks of Options Trading

While stock options can be a powerful addition to your investing toolbox, they carry risks. Options can expire worthless, leaving you with a loss equal to the premium paid. The leverage in options trading can magnify both gains and losses. Some strategies, especially those that involve selling options, can expose you to substantial risk if not managed carefully.

That’s why most experts recommend starting with simple options trades and never risking more than you are willing to lose. Many brokerage firms also require additional approval to trade options, ensuring that investors have a basic understanding before they get started.

Common Strategies for Beginners

Buying call options to bet on rising stocks

Buying put options to protect your investments or bet on a decline

Using covered calls to earn extra income on stocks you already own

Options are powerful but require education and discipline. Always understand the potential outcomes before entering a trade, and avoid risking more than you can afford to lose.

Should You Try Stock Options?

Stock options offer flexibility and power to those who understand them. They are not a shortcut to getting rich, but they can be valuable for managing risk, increasing returns, and navigating different market environments. Before trading options, take time to learn, practice with paper trading accounts, and use only money you can afford to lose. As with any financial tool, education and discipline are key to success.

Stock options are an essential part of modern investing. By understanding how call options and put options work, you can unlock new possibilities in your trading and investment journey.

For adsense add