What is 0x

- by:

- Nick H

Key Points

The 0x protocol is an open-source framework that enables decentralized trading

Unlike centralized exchanges, 0x allows users to maintain full control of their funds and trade directly from their own wallets

The protocol uses relayers for off-chain order management, which helps lower fees, speeds up trades, and aggregates liquidity from multiple sources

10 Stocks You Should Buy Before August >

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

The Future of Exchange: Understanding Decentralized Crypto Trading

Cryptocurrency has changed the financial landscape, offering new ways to move, store, and invest value. At the heart of this revolution is a major shift in how people trade assets. Traditional exchanges, which rely on centralized authorities, are being challenged by decentralized protocols that allow users to trade peer to peer, without trusting an intermediary. One of the pioneering projects in this space is the 0x protocol.

What Is 0x Protocol? A Blueprint for Open Trading

The 0x protocol is an open-source framework designed to facilitate the decentralized exchange of digital assets on the Ethereum blockchain. Created in 2017 by Will Warren and Amir Bandeali, 0x is not a standalone exchange, but a set of smart contracts and developer tools that anyone can use to build their own decentralized marketplace.

What sets 0x apart is its focus on efficiency, flexibility, and interoperability. The protocol allows any type of Ethereum-based asset, including popular tokens and NFTs, to be traded in a completely permissionless way. This means anyone with an internet connection and a compatible wallet can use 0x-powered platforms to trade assets directly with others, while maintaining control over their funds.

The Problems with Centralized Exchanges

To understand the value of the 0x protocol, it helps to look at the drawbacks of traditional centralized exchanges:

Custodial Risks: When you use a centralized exchange, you must trust the platform with your assets. History has shown that exchanges can be hacked, mismanaged, or even go bankrupt, putting user funds at risk.

Limited Transparency: Centralized exchanges operate behind closed doors, making it difficult for users to verify that trades are fair and assets are secure.

Regulatory and Access Barriers: Some users cannot access centralized exchanges due to regulatory restrictions or local laws. Others may be subject to high fees, withdrawal limits, or lengthy verification processes.

Downtime and Single Points of Failure: Centralized platforms can suffer outages, technical failures, or censorship, leaving users unable to access their funds or execute trades.

How 0x Protocol Works: The Architecture of Decentralization

The 0x protocol relies on Ethereum smart contracts to manage orders, settlements, and asset transfers. Here’s how it functions:

1. Off-Chain Order Relay

Unlike some decentralized exchanges that perform every action on-chain, 0x allows orders to be created, broadcast, and matched off-chain. Only the final settlement, where ownership of assets actually changes, is recorded on the Ethereum blockchain. This approach saves users on transaction fees and dramatically speeds up trading.

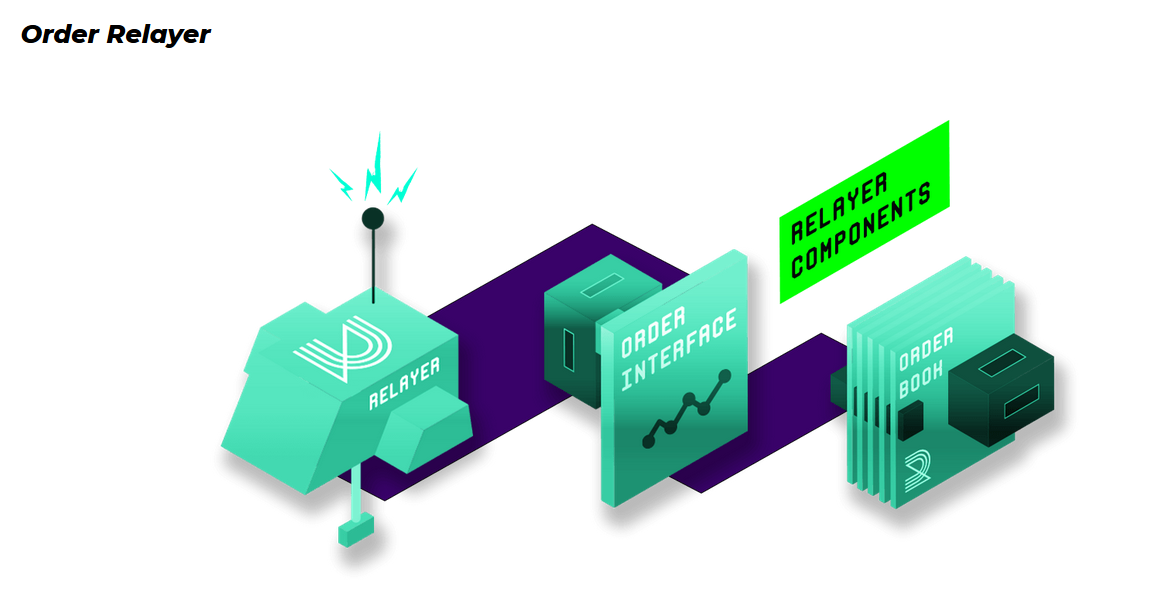

2. Relayers

Anyone can operate a relayer—essentially, a digital order book service that connects buyers and sellers. Relayers do not hold user funds, but instead facilitate the discovery and matching of orders. Examples of well-known 0x relayers include Matcha and Radar Relay.

3. Smart Contract Settlement

Once a buyer and seller agree to a trade, the transaction is executed on-chain via the 0x protocol’s smart contracts. This ensures that trades are secure, transparent, and cannot be tampered with.

4. Token Standards and Flexibility

0x is designed to support any token built on Ethereum, including ERC-20 fungible tokens and ERC-721 non-fungible tokens. This flexibility means the protocol can power markets for a wide variety of assets, from governance tokens to digital collectibles.

Most Like Articles

Key Features of the 0x Protocol

Permissionless Access

Anyone can use 0x-based platforms. There are no account registrations, and users never have to give up custody of their crypto assets.

Composability

0x is modular and interoperable. Developers can integrate the protocol into wallets, trading platforms, or even gaming applications, enabling innovative new use cases.

Liquidity Aggregation

By connecting multiple relayers and liquidity sources, 0x allows users to access deeper markets and more competitive pricing.

Upgradability

The protocol is designed to be upgradable without causing disruptions to existing users, ensuring that it can evolve as technology and market demands change.

The 0x Token (ZRX): Fueling the Protocol

At the center of the 0x ecosystem is the ZRX token. ZRX serves two main purposes:

Governance: Holders of ZRX can propose and vote on changes to the protocol, helping to guide the evolution of the 0x ecosystem.

Fee Payments: In some implementations, relayers may charge fees in ZRX for facilitating trades, providing an economic incentive to build and maintain relayer services.

The 0x Token (ZRX): Fueling the Protocol

At the center of the 0x ecosystem is the ZRX token. ZRX serves two main purposes:

Governance: Holders of ZRX can propose and vote on changes to the protocol, helping to guide the evolution of the 0x ecosystem.

Fee Payments: In some implementations, relayers may charge fees in ZRX for facilitating trades, providing an economic incentive to build and maintain relayer services.

Benefits for Traders and Developers

Greater Control and Security

Because 0x trades are non-custodial, users maintain control of their funds at all times. There’s no need to trust a third party or worry about hacks affecting an exchange’s hot wallet.

Global and Inclusive

Anyone with an Ethereum wallet can participate, regardless of location or status. This global access breaks down many of the barriers faced by traditional exchanges.

Lower Fees and Faster Trades

Off-chain order management and direct settlement reduce costs and speed up the trading process, making decentralized trading more attractive to active participants.

Developer Empowerment

0x provides a flexible toolkit for developers, enabling them to create new trading experiences, integrate liquidity, and build unique financial products without starting from scratch.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Tendie Shacks total average return is 1,053% — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Our Tendie Community.

*Tendie Shack returns as of today

Challenges and Considerations

No technology is without trade-offs, and decentralized protocols have their own challenges:

User Experience

While 0x aims to make trading smooth, decentralized apps can still feel unfamiliar or complicated compared to the seamless experience offered by centralized platforms.

Regulatory Uncertainty

As decentralized exchanges grow, regulators may increase scrutiny, raising questions about compliance and user protection.

Network Congestion and Fees

Although 0x minimizes on-chain activity, it is still dependent on the Ethereum network. High traffic can lead to congestion and increased transaction fees.

Real-World Example: Using a 0x-Powered Platform

Suppose you want to trade a rare NFT or a new DeFi token. Instead of sending your crypto to a centralized exchange, you log in to a 0x-powered platform like Matcha with your Ethereum wallet. You browse the available orders, find the best price, and complete your trade directly from your wallet. The order is settled via 0x smart contracts, and your new asset appears in your wallet—no sign-ups, no third-party custody, and no waiting for withdrawals.

The Big Picture: 0x’s Impact on Crypto Markets

0x protocol is a foundational technology for decentralized finance, helping to build a more open, secure, and efficient trading ecosystem. As more users and developers embrace decentralized solutions, protocols like 0x are paving the way for a future where anyone can trade assets freely, without relying on intermediaries.

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Tendie Shack Returns as of Today

For adsense add