How To Read Financial Statments

Why Reading Financial Statements is Important

Knowing how to read financial statements is essential because it allows investors to assess a company’s true profitability, financial stability, and growth potential before making investment decisions. Understanding these documents helps investors avoid risky companies, spot hidden strengths or weaknesses, and make smarter choices to maximize returns.

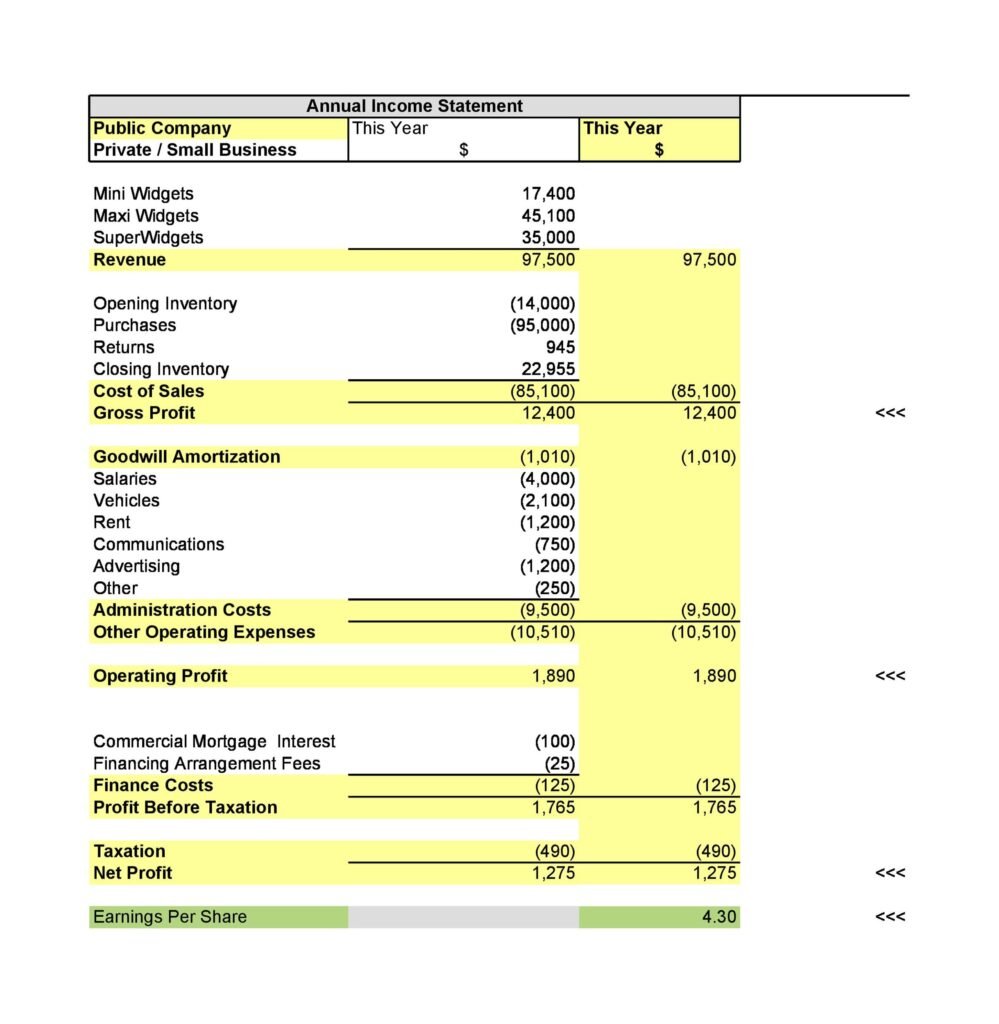

INCOME STATMENT

Purpose: summarizes a company’s revenues, expenses, and profits or losses over a specific period (such as a quarter or year). It tells you how much money the company made and spent, and ultimately, whether it was profitable.

Key Components:

Revenue (Sales)

Cost of Goods Sold (COGS)

Gross Profit

Operating Expenses (like salaries, rent, utilities)

Operating Income

Other Income and Expenses

Net Income (or Net Loss)

STATMENT OF SHAREHOLDERS EQUITYS

Purpose: This statement details the changes in equity for the reporting period. It explains how the company’s retained earnings, share capital, and other equity items change over time.

Key Components:

Opening and closing balances of equity

Issuance or buyback of shares

Dividends paid

Net income or loss for the period

Other comprehensive income

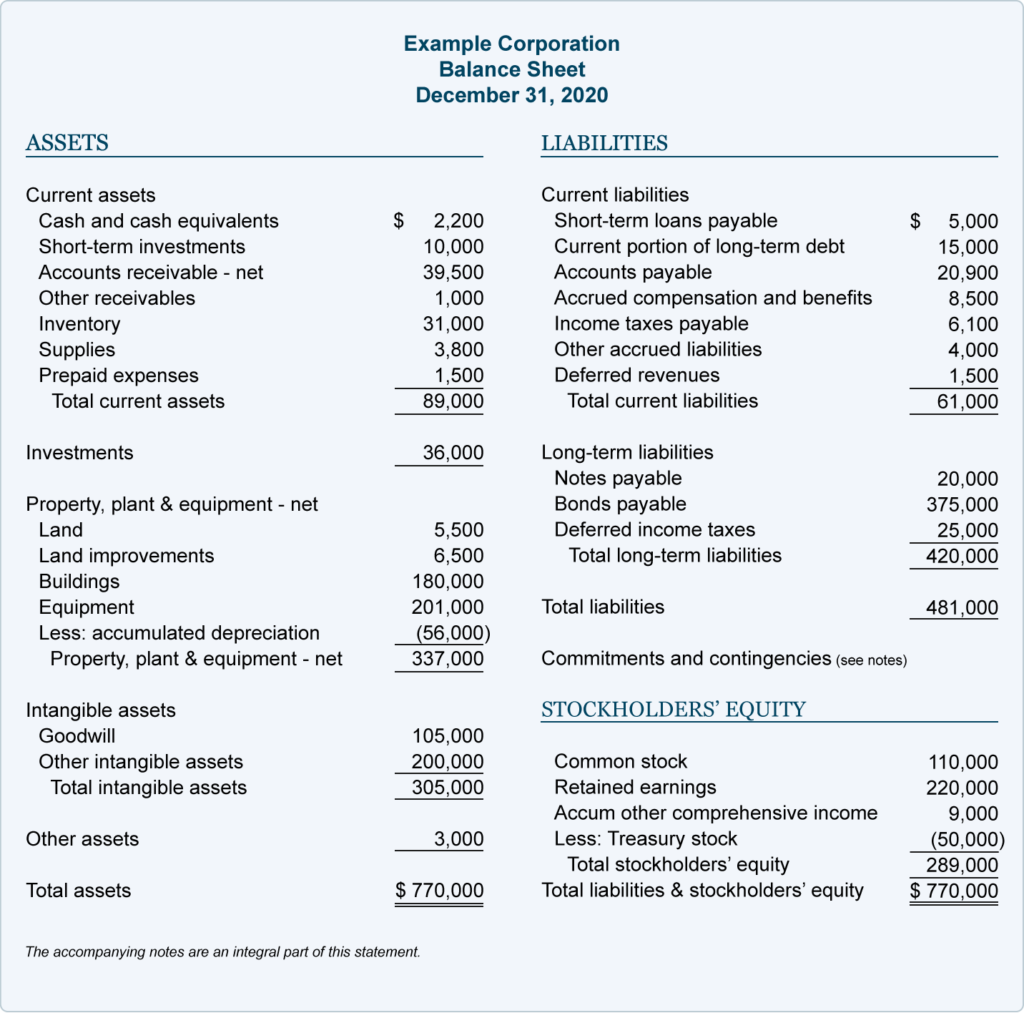

BALANCE SHEET

Purpose: The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It shows what the company owns and owes.

Key Components:

Assets (Current and Non-current)

Cash and equivalents, Accounts receivable, Inventory

Property, plant, and equipment

Liabilities (Current and Non-current)

Accounts payable, Short-term debt

Long-term debt

Shareholders’ Equity

Common stock

Retained earnings

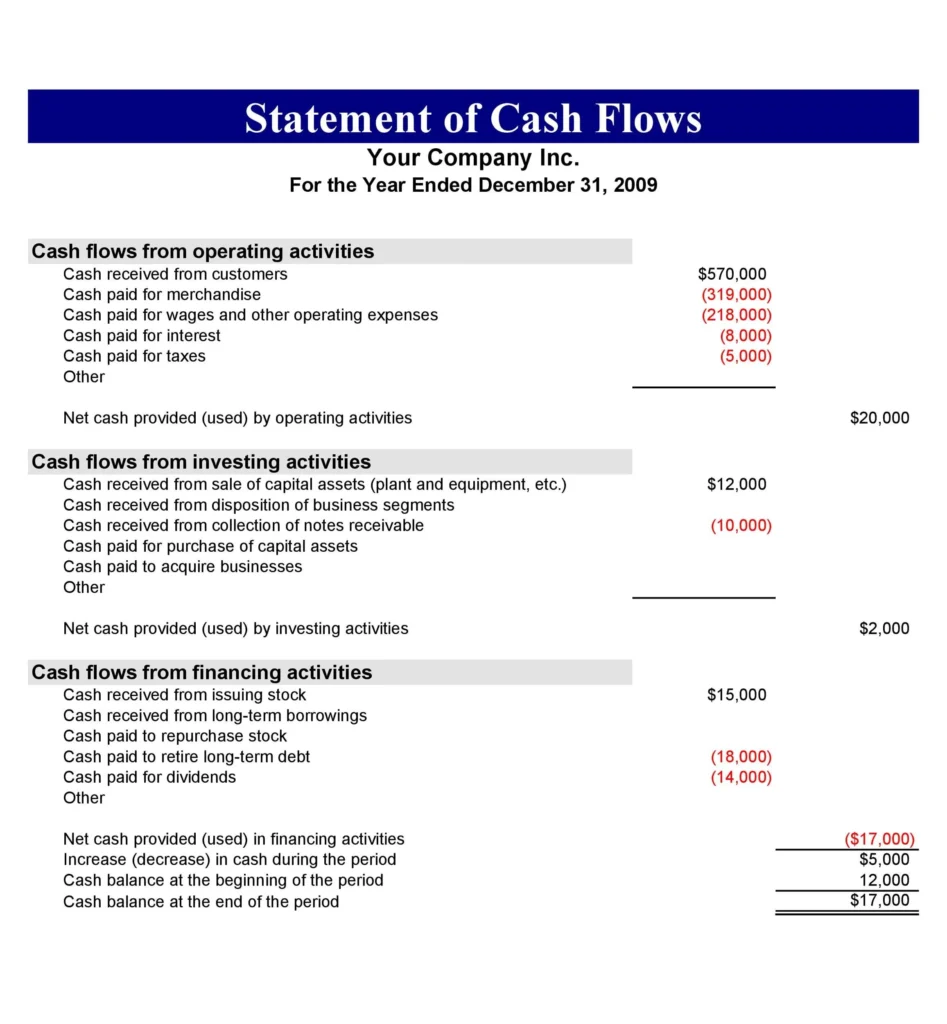

STATMENT OF CASH FLOWS

Purpose: The cash flow statement tracks the flow of cash in and out of the business over a period of time. It focuses strictly on actual cash, not accounting entries.

Key Components:

Operating Activities (cash from main business activities)

Investing Activities (cash from buying or selling assets)

Financing Activities (cash from borrowing, repaying debt, or equity transactions)

Net Increase or Decrease in Cash