What Is a Stock

- by:

- Nick H

Key Points

Stocks are real ownership in companies, giving you a share of assets, profits, and voting rights

Stock prices move based on both company fundamentals and market sentiment, often making them unpredictable

Long-term wealth from stocks comes from both price appreciation and reinvested dividends

what is a call option

For adsense add

Advertisement

affiliate add

For adsense add

Mail Sign Up

Get The Latest News & Stock Picks

Stay ahead of the market with expert news, actionable tips, and exclusive stock picks delivered straight to your inbox. Join a community of investors who value real insights and smarter strategies. Sign up now and get the edge you need to invest with confidence.

By submitting your email, you agree to receive updates and promotional content from our team. You can unsubscribe at any time. For more details, please review our Privacy Policy.

For adsense add

For adsense add

A Real-World Guide for Anyone Who Wants to Actually Understand Stocks

If you walk down Wall Street in New York City or scroll through your favorite finance app, you’ll see the word “stock” almost everywhere. People talk about owning stocks, trading stocks, getting rich off stocks, or sometimes losing everything in stocks. But what are they, really?

A stock is not just a number or a symbol on a screen.

It’s a tiny piece of a real business. When you own even a single share of a company like Apple, you actually own a slice of Apple itself. Legally, that means you have a claim on the company’s assets, profits, and even a bit of influence (however tiny) over how the company is run. That’s why stock is sometimes called “equity”—you literally have a share in the company’s equity.

Stocks are the original crowdfunding tool. Before there were Kickstarter campaigns, there were merchants pooling money to fund ships, explorers, or factories. The earliest joint-stock companies let regular people (not just royalty or aristocrats) invest and share in the profits. That’s the foundation of the modern stock market.

Why Companies Sell Pieces of Themselves

Imagine you’re building a killer new business—a bakery, a robotics startup, or maybe a new streaming platform. At some point, you want to grow faster than you can with your own savings. You can borrow money (which comes with interest and pressure), or you can sell part of your business in exchange for cash. That’s what selling stock is: giving investors a piece of your business in exchange for capital you use to grow, innovate, or just survive tough times.

When companies “go public” and offer stock to anyone, they raise massive sums. But they also become accountable to a legion of outside investors. Those investors now share in both the risk and the reward.

What You Get When You Buy a Stock

Most people think of stocks as lottery tickets or quick money machines. That’s a rookie mistake. Stocks are claims on the future. The only reason a stock has value is because you expect the company to do things—sell products, earn profits, pay dividends, or get acquired. If the business thrives, so does your stock price. If it fails, your shares can become worthless.

There are a few key things that come with owning stocks:

Ownership: Real, legal ownership. If you own 1% of a company, you own 1% of every building, patent, contract, and profit it ever earns.

Voting rights: Most common stocks let you vote on key issues, like electing board members.

Dividends: Some companies share profits with owners, sending you regular cash payouts.

Potential for growth: If the business gets bigger, your shares become more valuable.

The catch? There are no guarantees. The stock market is ruthless. When you own stock, you accept both the upside and the risk.

Common vs. Preferred Stock

Even among stocks, there’s more variety than meets the eye.

Common stock is what most people own. You get voting rights, potential dividends, and all the ups and downs of the market.

Preferred stock is a hybrid—it acts a bit like a bond, paying fixed dividends but rarely offering voting rights. In bankruptcy, preferred shareholders get paid before common shareholders, but that’s cold comfort if the company is in deep trouble.

What Really Moves Stock Prices?

If you’re a new investor, you probably wonder why stock prices go up and down so much. Are they random? Are they rigged? Is it just hype and hope?

At the deepest level, a stock’s price reflects what people think the company’s future profits are worth right now. If investors believe a company will make tons of money, they’ll pay more for a share. If they think profits will fall, the price drops. But markets are not always rational. News, rumors, politics, new products, scandals, and even viral memes can send prices soaring or crashing. That’s why “fundamentals” (like sales and profits) matter, but “sentiment” and “momentum” matter too.

Here’s how advanced investors break it down:

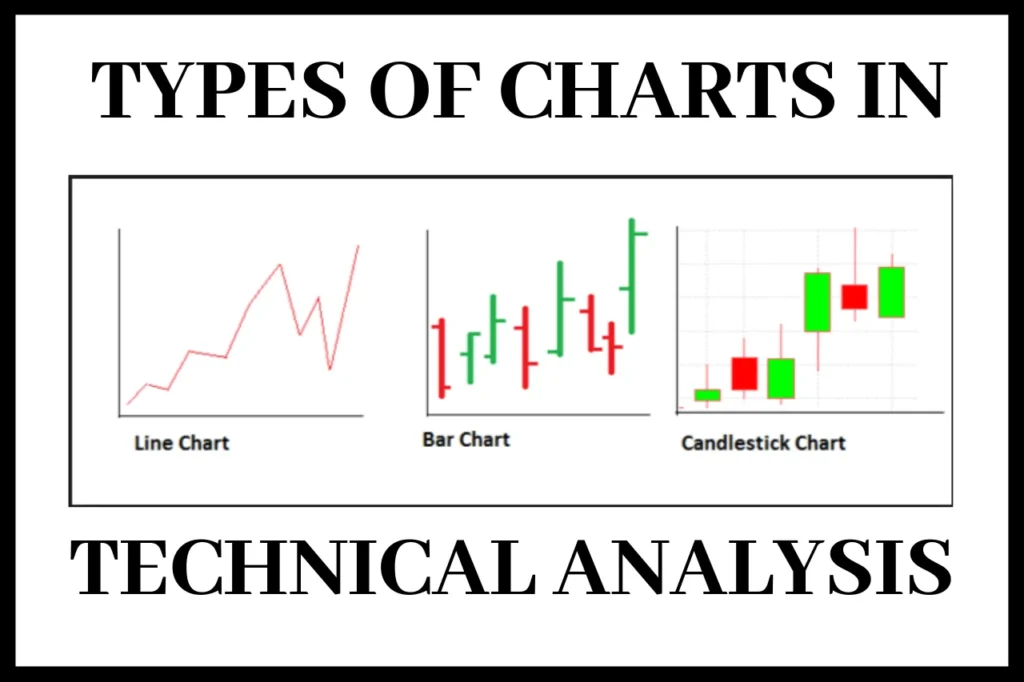

Fundamental analysis: Looks at earnings, sales, assets, debts, industry trends, and management.

Technical analysis: Studies price patterns, trading volume, and historical trends—basically, trying to predict the crowd’s next move.

Macro trends: Central banks, interest rates, inflation, wars, and government policies all impact entire sectors or the whole market.

Why Trade Stocks?

Why not just put your money in a bank account? Because over the long haul, stocks have created more wealth than any other mainstream investment. They reward you for taking risk and for backing businesses that move the world forward.

But here’s the dark side: stocks can also destroy wealth, quickly and brutally. A single bad earnings report or a change in regulation can cut a company’s value in half overnight. Anyone who tells you stocks are “safe” is lying or selling you something.

How Advanced Investors Think About Stocks

For professionals and seasoned traders, stocks are not just investments—they’re tools. Some use stocks for income, buying companies with stable dividends. Others look for explosive growth, hunting small firms before they go big. Hedge funds may use stocks for complex strategies like short selling (betting a company will fall), pair trading (buying one stock, selling another), or hedging against other risks in their portfolio.

Seasoned investors also understand the role of psychology. Market panics, euphoria, herd mentality—these are not just buzzwords, they are forces that can move markets just as powerfully as profits and losses.

The Real Benefits and Risks

Owning stocks means signing up for both upside and downside. Here’s a real-world snapshot:

Benefits:

Long-term wealth creation (historically, stocks outperform bonds, real estate, and cash over decades)

Liquidity (you can buy and sell most stocks instantly)

Diversification (own pieces of hundreds of businesses with index funds or ETFs)

Access to global innovation (the best new ideas and growth stories usually come to the stock market first)

Risks:

Volatility (prices can swing wildly, especially in bad markets)

Company risk (bad management, fraud, or failure wipes out shareholder value)

Market cycles (even good stocks drop during recessions or bear markets)

Emotional mistakes (panic selling, FOMO buying, holding losers too long)

The Role of Dividends and Income

Many people think you only make money in stocks when the price goes up. In reality, a huge part of long-term returns comes from dividends—companies sharing profits with their owners. Some of the world’s best investors (think Warren Buffett) focus on stocks that pay and raise dividends over time. Reinvesting those dividends can turn a good investment into a great one, thanks to the magic of compounding.

Stocks in Your Portfolio

The stock market is not just for day traders or rich people in suits. Anyone with a smartphone and a few bucks can buy shares today. But that doesn’t mean you should throw all your money at the next hot stock. A smart investor builds a portfolio—a collection of stocks, funds, and maybe other assets that work together.

Index funds and ETFs let you own hundreds or thousands of stocks at once, spreading your risk. For most investors, this is the surest path to wealth: steady, diversified, and focused on the long term.

Advanced: Taxes, Indexes, and Modern Markets

For those with bigger portfolios or advanced strategies, details matter. In most countries, profits from stocks (capital gains) are taxed differently based on how long you hold them. Trading in and out quickly usually means higher taxes, while holding for a year or more often means lower rates.

Stock market indexes—like the S&P 500 or Nasdaq—track groups of stocks and let you see how the market as a whole is performing. Many professionals compare their returns to these benchmarks. Others invest directly in index funds, betting that “owning the market” is safer than trying to pick winners.

Technology has changed the game, too. Fractional shares, instant trading, zero-commission brokers, algorithmic trading—these are features even advanced traders could only dream of twenty years ago.

Final Thoughts: Stocks Are Ownership, Not Just a Game

Owning stock means owning a piece of the world’s most dynamic companies. It’s a chance to share in the rewards of innovation and entrepreneurship, but it’s also a serious responsibility. The market rewards knowledge, patience, and courage. It punishes greed, fear, and ignorance.

If you want to succeed—whether you’re buying your first share or trading complex strategies—always remember: behind every stock is a real company, run by real people, facing real challenges. The more you understand, the smarter (and more profitable) your decisions will be.

For adsense add